When we talk about the cloud today, three names dominate the conversation: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. But the balance of power has been shifting over the past decade. Looking at the numbers from 2015 to 2025, we can see not only what happened but also why Azure has steadily risen, how AWS has defended its lead, and what this means for the future of cloud.

Market Share Trends (2015–2025)

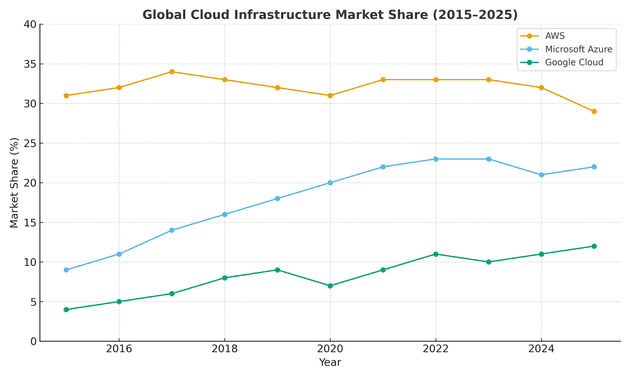

The chart below shows how the market shares of AWS, Azure, and Google Cloud have evolved over the past ten years.

Source: Synergy Research Group, Canalys, Gartner, IDC (2015–2025). Percentages represent global cloud infrastructure services revenue.

Source: Synergy Research Group, Canalys, Gartner, IDC (2015–2025). Percentages represent global cloud infrastructure services revenue.

From Dominance to Duopoly

In 2015, AWS towered over the market with more than 30% share, while Azure was in the single digits and Google Cloud barely registered. Fast forward to 2025, and the picture looks very different:

- AWS: down to ~29% share, still the leader but no longer expanding its lead

- Azure: up to ~22%, consistently narrowing the gap

- Google Cloud: ~12%, a respectable but distant third

The shift isn’t about AWS collapsing — in fact, AWS’s revenues grew massively. The key is that Azure grew faster, consistently outpacing the overall market as enterprises embraced Microsoft’s hybrid cloud strategy and integrated ecosystem.

Why Azure Caught Up

Three forces explain Azure’s rise:

-

Enterprise foothold Microsoft leveraged decades of enterprise relationships — Office, Windows Server, SQL Server — to bundle Azure into existing contracts. CIOs found it easier to extend into Azure than to start fresh with AWS.

-

Hybrid & compliance edge Unlike AWS, which pushed for an all-in cloud model, Microsoft leaned into hybrid deployments. That positioned Azure as the safer choice for regulated industries (finance, government, healthcare) where on-prem integration was non-negotiable.

-

AI acceleration In recent years, Microsoft’s massive bets on AI infrastructure and OpenAI partnership turned Azure into the go-to platform for generative AI workloads. This drove incremental share gains in 2023–2025 as enterprises raced to adopt AI.

How AWS Held the Line

If Azure has been gaining, why hasn’t AWS lost more? Because AWS has remained a growth engine in absolute terms. The market itself exploded — from ~$20B in 2015 to nearly ~$300B+ by 2025 — and AWS scaled right alongside it. Even with a flat or slightly declining share, AWS still adds more revenue every year than many competitors generate in total.

AWS’s strategy has been to expand breadth: thousands of services, global infrastructure, and relentless innovation in compute, storage, and networking. This ensured that while Azure gained ground, AWS’s dominance didn’t erode the way some predicted.

Google Cloud: The Steady Climber

Google Cloud’s story is different. Long lagging behind, it found traction in data analytics, AI, and multi-cloud openness. While still far smaller than AWS or Azure, its rise from low single digits to double digits shows that the “big three” dynamic is stable: AWS, Azure, Google now account for over 60% of global cloud spend.

The Essence of the Trend

The essence of the past decade is not AWS falling, but Azure’s relentless rise into a true duopoly. In 2015, AWS had more than triple Azure’s share; today, it’s closer to a 29% vs. 22% split. The battle is no longer about if Azure can challenge AWS, but how much further it can close the gap.

- AWS = breadth + first-mover advantage

- Azure = enterprise integration + hybrid strategy + AI momentum

- Google = data/AI niche, consistent but smaller scale

Looking Ahead

Going into the next few years, the story will hinge on AI-driven demand and enterprise modernization. Azure is well-positioned, but AWS’s scale means it will remain formidable. Google Cloud could benefit disproportionately if AI workloads tilt toward its strengths.

The takeaway: the cloud market has matured into a three-horse race, but the real rivalry is between AWS and Azure — a duopoly that defines how digital infrastructure evolves worldwide.